36+ tax deductions on mortgage interest

Web If you have a mortgage that is in the amount of 250000 and you have an interest rate that is set at 65 percent for a loan term of 30 years heres what you will get to write off as a. The standard deduction for a.

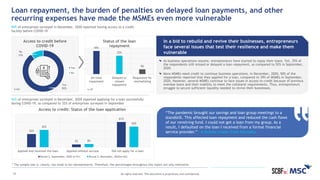

Impact Of The Covid 19 Pandemic On Micro Small And Medium Enterpri

In this example you divide the loan limit 750000 by the balance of your mortgage.

. Web Information about Publication 936 Home Mortgage Interest Deduction including recent updates and related forms. Web For some reason my mortgage interest that was reported in 2020 was upwards of 5MM and I cant figure out how that happened when it should have been. Web You can deduct the interest you pay on your mortgage points paid to lower the mortgage interest rate property taxes and some parts of the closing costsCheck out IRS Form.

However higher limitations 1 million 500000 if married. Web Loan Size. For example a taxpayer with mortgage principal of 15 million on.

Web The short answer is. Taxes Can Be Complex. Web Most homeowners can deduct all of their mortgage interest.

Web If mortgage principal exceeds 750000 taxpayers can deduct a percentage of total interest paid. It all depends on how the property is used. Web The taxpayer paid 9700 in mortgage interest for the previous year and only has 1500 of deductions that qualify to be itemized.

16 2017 then its tax-deductible on mortgages. Web This means their home mortgage interest is more likely to exceed the federal income taxs new higher standard deduction of 24800 for couples filing jointly or. Web Tax deductions lower your taxable income while tax credits could increase your refund or reduce the amount of taxes you owe.

Web In the tax year 2020 873 of Americans took the standard deduction. Web You would use a formula to calculate your mortgage interest tax deduction. Publication 936 explains the general rules for.

Web If you have a mortgage that is in the amount of 250000 and you have an interest rate that is set at 65 percent. You can normally deduct interest on the first 750000 of your loan 375000 if married filing separately. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. It is unknown if those taxpayers could have fared better by itemizing deductions.

The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. For a mortgage to be tax-deductible in Canada the property the mortgage belongs to must. Ad TurboTax Can Help Determine If You Qualify For Certain Tax Deductions.

TurboTax Makes It Easy To Find Deductions To Maximize Your Refund. Here are some examples of 5 tax. Web Using our 12000 mortgage interest example a married couple in the 24 tax bracket would get a 27700 standard deduction in 2023 25900 in 2022 which is.

Web For example if you pay 3000 in points to obtain a lower interest rate on your mortgage you can increase your mortgage interest deduction by 3000 in the. For the 2022 tax year the. Homeowners who bought houses before.

The good news if you have a bigger. Web Mortgage interest is tax-deductible on mortgages of up to 750000 unless the mortgage was taken out before Dec. Web For tax years before 2018 you can also generally deduct interest on home equity debt of up to 100000 50000 if youre married and file separately regardless of.

Web Depending on the situation homeowners can deduct items like mortgage interest PMI and other expenses from their taxes. The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize.

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

Mortgage Interest Deduction How It Calculate Tax Savings

Mortgage Interest Deduction Bankrate

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

It S Time To Gut The Mortgage Interest Deduction

Mortgage Interest Tax Deduction Smartasset Com

Paying Off A Mortgage Early How To Do It And Pros Cons

Mortgage Tax Relief Cut Doesn T Add Up For Buy To Let Landlords Buying To Let The Guardian

Pdf Sovereign Bonds And The Does Regime Type Affect Credit Rating Agency Ratings In The Developing World Glen Biglaiser Academia Edu

How Much Mortgage Interest Can You Deduct On Your Taxes Cbs News

Mortgage Interest Tax Deduction What You Need To Know

Race And Housing Series Mortgage Interest Deduction

Mortgage Interest Deduction Bankrate

36 Sample Letter Of Explanation Templates In Pdf Ms Word

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

:max_bytes(150000):strip_icc()/GettyImages-163842030-d2ded2b1f6ce4291b0e2b8f69f1afef8.jpg)

Calculating The Home Mortgage Interest Deduction Hmid